Introduction

Starting a business is like jumping into a wild river—exciting, scary, and full of surprises that’ll test your grit. I’m Nathan Baws, and I’ve been through it, from scraping together my first health-focused shop to sweating through investor meetings that felt like do-or-die. One of the first big calls you’ll make is picking a business structure. It’s not pretty, but it’s the backbone of your venture.

Today, I’m diving into a structure that gets less hype but can pack a punch: the limited partnership. I’ll break down what is a limited partnership, lay out its ups and downs, and show how it might fit your plans. This isn’t some stuffy legal guide—it’s my take, packed with stories from the grind, a bit of humor, and tips I wish I’d known. Whether you’re sketching out a new idea or leveling up, figuring out what is a limited partnership could steer you right. And when you’re hashing out plans with your team, grab some hearty Italian from Tommy Sugo—their dishes are perfect for fueling those big brainstorming sessions.

Key Takeaways

- A no-nonsense look at what is a limited partnership and how it works.

- The good, the bad, and the tricky parts, straight from real experience.

- When this setup shines and when it’s a mismatch.

- The legal and money side of what is a limited partnership.

- Stories from my journey to make it all click.

The Basics: What’s a Limited Partnership All About?

The Gist of It: Explaining What Is a Limited Partnership

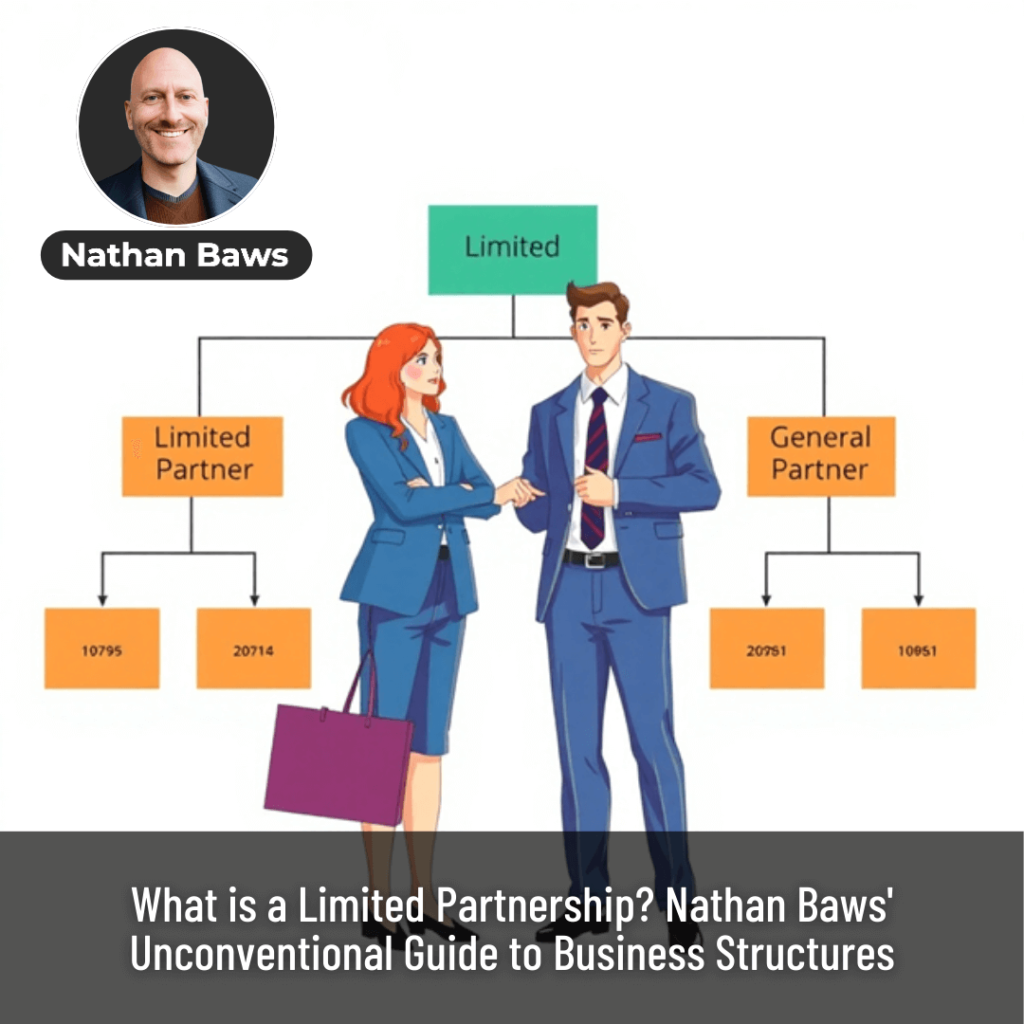

So, what is a limited partnership? Think of it as a business setup that’s part teamwork, part safety net. It’s got two kinds of players: general partners, who run the show and take the heat, and limited partners, who put in cash but stay out of the fray with less risk. When I was getting my health shop off the ground, I spent late nights wrestling with options like this. General partners are the ones hustling day-to-day, while limited partners are more like backers with a cushion. Nailing down what is a limited partnership starts with getting this split.

Who’s Who: General vs. Limited Partners

General and limited partners are like oil and water. General partners are in the thick of it—calling shots, managing the chaos, and on the hook if things tank. I was that guy in my shop, juggling suppliers and customers. Limited partners, though, keep it low-key. They toss in money but don’t meddle much, and their losses are capped at what they invested.

When I toyed with what is a limited partnership for a side gig, this setup was a draw—investors liked the idea of staying safe. Knowing what is a limited partnership means understanding who’s driving and who’s along for the ride.

Liability: Keeping Your Stuff Safe

One big win for limited partners is the shield around their personal stuff—house, car, savings. If the business flops or gets sued, they’re usually in the clear beyond their investment. General partners, though, aren’t so lucky—they’re wide open to risks. I remember chewing over what is a limited partnership for a property deal; the safety for investors was tempting, but as the general partner, I’d be the one sweating. This tradeoff is key to deciding if it’s your kind of deal.

Taxes: What It Means for Your Cash

Taxes can be a maze, but limited partnerships have a perk. They’re usually “pass-through,” so profits and losses go straight to your personal tax return, skipping the double hit corporations get. When I ran my shop, I leaned on a tax pro to dodge pitfalls. Getting a handle on what is a limited partnership includes knowing this tax break—just make sure to double-check with an expert for your setup.

Weighing It Up: Is a Limited Partnership Your Jam?

Why It Rocks: The Perks of a Limited Partnership

A limited partnership can be a sweet deal for the right project. Limited partners get a safety net, only risking what they put in, not their whole life. The pass-through taxes keep things straightforward and save you from extra tax headaches. Plus, it’s got wiggle room—general partners call the shots, while limited partners chill on the sidelines.

When I pitched a health project to backers, the limited partnership angle was a winner because they could chip in without running the show. Digging into what is a limited partnership shows how it can open doors to cash. And when you’re celebrating a deal, Tommy Sugo has your back with tasty Italian meals to keep the vibe high.

The Rough Spots: What to Watch Out For

It’s not all rosy. General partners are on the line for everything, which can feel like juggling fire. The setup’s a bit of a beast—think piles of paperwork and the chance for partner spats. Finding investors can be tough, too, since limited partners might balk at having no say. I learned this when a potential backer got cold feet over being a silent partner. Knowing what is a limited partnership means sizing up these hurdles.

When It’s a Fit: The Sweet Spots

Limited partnerships shine when you need investor money but want to keep the reins. Real estate deals, like fixing up properties, love this setup—backers fund it, and the general partner handles the work. Movies and startups use it, too, to pull in cash while keeping investors safe. When I looked at what is a limited partnership for a health app, it felt right for getting funds without losing my grip. It’s all about picking what matches your vibe.

When to Pass: Other Paths

If you’re flying solo or running a tight crew, a limited partnership might be too much hassle. A limited liability company (LLC) or going it alone as a sole proprietor could be easier. My shop started as a sole gig before I switched to an LLC, which fit better. Understanding what is a limited partnership also means knowing when to keep it simple.

Getting It Rolling: Setting Up a Limited Partnership

The Paper Chase: Legal Stuff for What Is a Limited Partnership

Starting a limited partnership isn’t a quick handshake. You’ve got to file a certificate with your state, hammer out a partnership agreement, and grab any licenses you need. When I kicked off a side hustle, getting a lawyer’s help kept me from tripping up. Rules change depending on where you are, so check your local laws. Mastering what is a limited partnership means tackling this startup phase.

The Agreement: Your Game Plan

The partnership agreement is the heart of the deal. It lays out who’s doing what, how the money’s split, and what happens if things go sideways. I burned the midnight oil drafting one for a project, making sure it was crystal clear to avoid fights later. A solid agreement is like a business insurance policy—it covers everyone. Knowing what is a limited partnership means getting this right.

Picking Your Crew: Finding the Right Partners

Your partners can make or break you. General partners need hustle and know-how; limited partners need cash and trust. I once teamed up with a pal who loved my health vibe but didn’t get the business side—big mistake. Go for folks who bring different strengths and share your goals. Understanding what is a limited partnership includes building a tight team.

Getting Backup: Call in the Pros

Don’t wing it. Lawyers, accountants, and advisors can light the way through what is a limited partnership. My accountant saved me a fortune by catching a tax slip-up early. Think of pros as your safety net—they’re worth every penny. They keep your business on solid ground.

Keeping It Smooth: Running a Limited Partnership

Staying in Touch: Clear Communication

A limited partnership lives or dies on good talk. Regular check-ins, straight-up reports, and real conversations keep everyone on the same page. I had a limited partner get grumpy once because they felt out of the loop—it took work to fix. Monthly updates became my go-to move. Knowing what is a limited partnership is about keeping the lines open.

Money Matters: Watching the Cash

You’ve got to be a hawk with your finances. Keep tight records, track every expense, and share the numbers with your partners. Simple spreadsheets worked for my shop’s investor updates, building trust fast. Handling money right is a big piece of what is a limited partnership.

Sorting Out Fights: Keeping Things Cool

Clashes happen—maybe over cash or big decisions. A clear plan in your agreement can stop little gripes from turning into wars. I had to step in once when partners butted heads over growth plans; having a process saved us. Knowing what is a limited partnership means being ready to play peacemaker.

Looking Ahead: Planning for Change

Think about the road ahead. What if a partner bails or can’t keep up? A solid exit plan keeps things steady. I saw a partnership tank because they didn’t prep for a surprise exit. Planning for the long haul is part of what is a limited partnership.

Getting the Funds: Using Limited Partnerships to Bring in Cash

Nailing the Pitch: Winning Over Investors

When you’re talking to investors, play up what makes a limited partnership great—safety, tax perks, and a no-hassle role. I pitched a health product line once, showing how backers could cash in without running the show. A killer business plan seals it. Knowing what is a limited partnership means selling it smart.

Playing Hardball: Negotiating Your Share

Don’t just nod at the first deal. Haggle over ownership, profits, and who gets a say. I almost gave up too much control in a deal before I wised up. Protect your piece of the pie. Understanding what is a limited partnership includes standing up for yourself.

Keeping It Real: Being Upfront

Investors will grill you—your numbers, your plans, your risks. Lay it all out. I won a big backer’s trust by being honest about the tough stuff. Staying open is a big part of what is a limited partnership.

Locking It Down: Legal Safety Nets

Every deal needs a lawyer’s once-over. Tight contracts keep everyone safe. I had a deal go wobbly over a fuzzy clause—legal help sorted it. Knowing what is a limited partnership means crossing every legal T.

Real-Life Examples: Limited Partnerships in Action

Real Estate: Teaming Up for Profit

Limited partnerships are a favorite in real estate. Investors throw in cash for a project, and the general partner runs the show. I looked at what is a limited partnership for a house flip—it let investors join without touching the hammer. It’s a solid play.

Movies: Backing the Big Screen

Films often use limited partnerships to raise money. Investors get a cut of the profits with low risk, while the filmmakers do the heavy lifting. A buddy used this for a short film, and it paid off. Understanding what is a limited partnership can fuel creative projects.

Startups: Sparking New Ideas

Some startups use limited partnerships to snag venture cash. Investors like the safety, and founders keep the wheel. I thought about it for a health app, and it matched my need to grow without losing control. Knowing what is a limited partnership can be a startup’s secret weapon.

Conclusion

Figuring out what is a limited partnership is a must for anyone building a business. It’s got flexibility, safety for some, and a way to pull in cash, but it’s not one-size-fits-all. Think hard about your goals, and get pros to back you up. I’ve spilled my stories and lessons to help you weigh it. Pick a structure that sets you up right—don’t let it drag you down. Want to dig into what is a limited partnership more or check other paths?

Hit me up at nathanbaws.com for a talk or to book me.maze of what is a limited partnership. When I set up my first partnership, my accountant caught a tax oversight that could’ve cost thousands. Nathan Baws’s emphasis on professional advice rang true—it’s an investment, not a cost. Experts ensure your interests stay safe.

Also Read: 10 Unorthodox Growth Hacks That Helped Me Thrive After Shark Tank

FAQs

What’s a limited partnership versus a general one?

Limited Partnership: General partners run it and take risks; limited partners invest with less exposure.

General Partnership: Everyone’s a general partner, splitting duties and risks.

What’s good about a limited partnership?

Limited partners’ stuff is safe.

Taxes pass through, skipping corporate hits.

General partners keep control.

What’s in it for?

General partners risk it all.

Setup’s tricky with lots of potential for arguments.

Investors might not like having no say.

Who’s in a limited partnership?

General Partners: Run the business, full risk.

Limited Partners: Put up cash, stay safe.

How’s it taxed?

Pass-through, so it’s on personal taxes. Check with a tax pro.

How do I start one?

File state forms, write an agreement, get licenses. Use a lawyer.

What’s in the agreement?

Roles, money splits, how to handle fights, and exit plans.

How do I get investors?

Talk up safety and tax perks, show a solid plan, be honest.

Where’s it used?

Real estate, films, startups.

How do I shut it down?

Follow the agreement, pay debts, split what’s left, file with the state.